Why Every Homeowner Should Consider a Will or Trust: A Real Estate Agent’s Perspective

As a real estate agent, I often see the excitement that comes with buying a new home—the joy of finding the perfect space, planning for the future, and putting down roots. But there’s another important step that many homeowners overlook: making sure your investment is protected for generations to come. That’s where having a will or trust comes in.

As a real estate agent, I often see the excitement that comes with buying a new home—the joy of finding the perfect space, planning for the future, and putting down roots. But there’s another important step that many homeowners overlook: making sure your investment is protected for generations to come. That’s where having a will or trust comes in.

Think of your home as more than just four walls and a roof; it’s a legacy. Without a clear plan, what happens to your property if something unexpected occurs? The truth is, without a will or trust, your loved ones could face legal headaches, delays, and even disputes during an already difficult time.

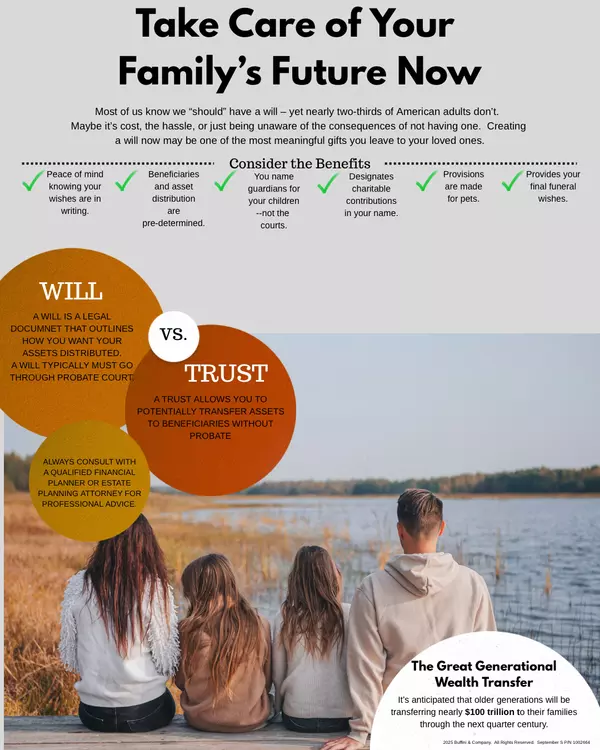

Why a Will or Trust Matters for Homeowners

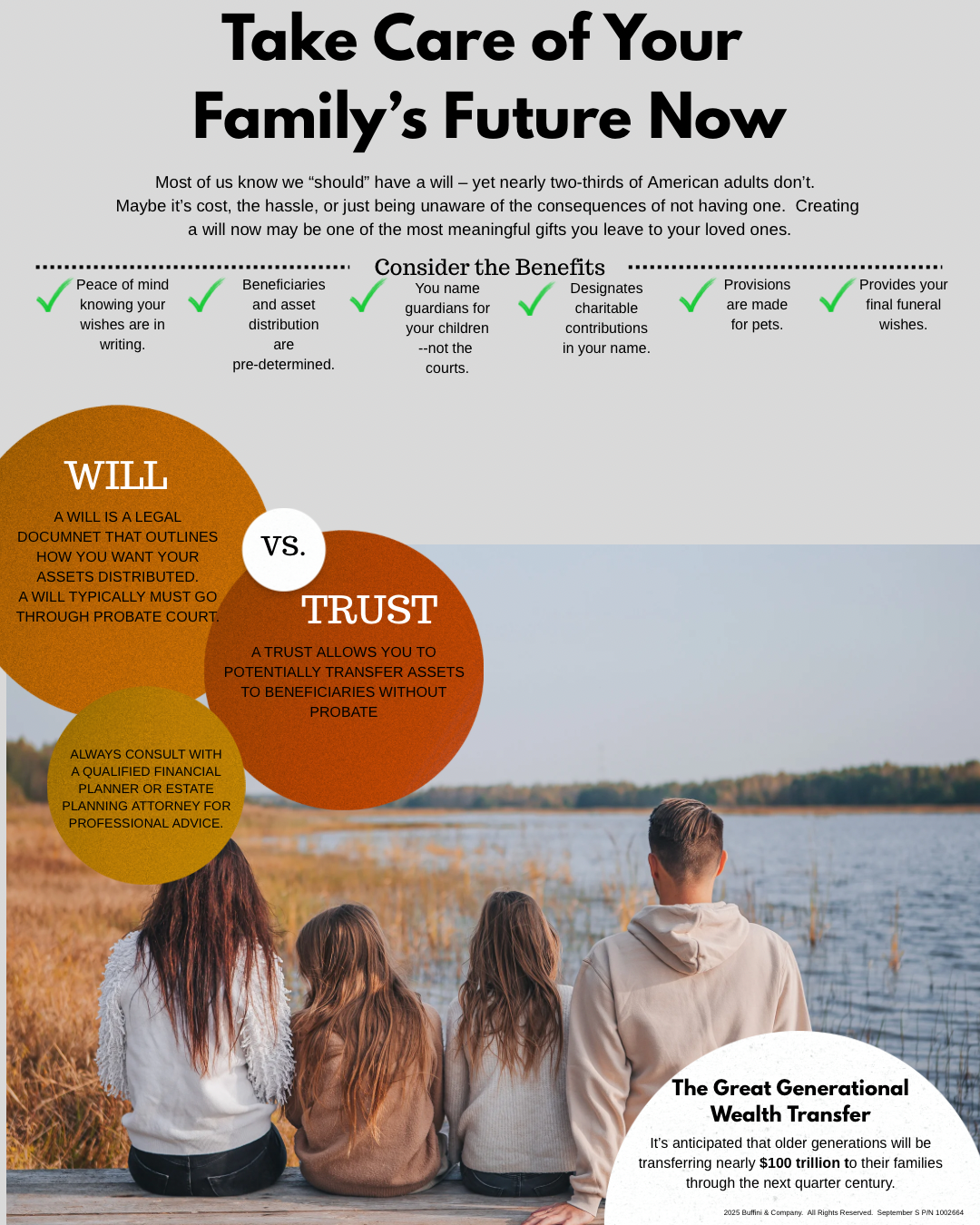

- Avoiding Probate Hassles: If you pass away without a will, your property may go through probate—a lengthy and often costly legal process. A will or trust can help streamline the transfer of your home to your chosen beneficiaries.

- Protecting Your Loved Ones: Clear instructions ensure your family knows exactly what you want, preventing misunderstandings and potential conflicts.

- Preserving Your Legacy: Whether your home is a starter condo or a family estate, a will or trust gives you control over who inherits your property and under what terms.

Real-Life Example

I’ve worked with families who, after losing a loved one, found themselves tangled in red tape because there was no will or trust in place. In contrast, clients who planned ahead were able to transition property smoothly, honoring their loved one’s wishes without added stress.

What’s the Difference?

- Will: A legal document that spells out who gets your assets after you’re gone. It goes into effect upon your death and may go through probate.

- Trust: A trust can take effect while you’re alive and can help avoid probate altogether. It offers more privacy and flexibility, especially for complex estates.

Take the Next Step

As you celebrate your new home or think about your current one, consider talking to an estate attorney about your options. It’s one of the best gifts you can give your loved ones—and yourself—for peace of mind.

Have questions about how your property fits into your long-term plans? I’m here to help you navigate every step of homeownership, including the important conversations about your legacy.

Categories

Recent Posts

GET MORE INFORMATION